To address the liquidity issue in the real estate market through fractional tokenization using blockchain technology

Welcome to Keikuza: Revolutionizing Real Estate Investment

Keikuza is a cutting-edge platform that leverages the power of decentralized fractionalized tokenization (DFT) to transform the way you invest in real estate. By breaking down traditional barriers, Keikuza makes real estate investment more accessible, liquid, and transparent for everyone.

Keikuza is more than just a platform—it's a community of forward-thinking investors embracing the future of real estate. Whether you're a seasoned investor or just starting, Keikuza offers the tools and opportunities you need to diversify your portfolio and achieve your investment goals.

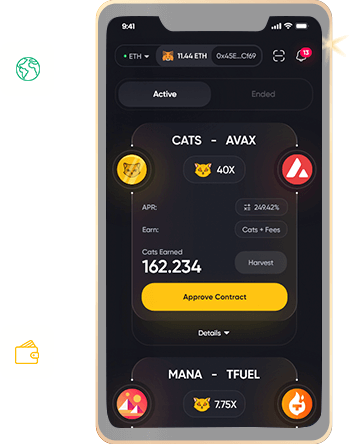

Properties listed on Keikuza are divided into digital tokens, each representing a fraction of the ownership. This allows you to invest in a share of a property rather than needing to buy the entire asset.

You can purchase these tokens through our user-friendly platform. Once you own tokens, you can trade them on our marketplace, providing you with greater liquidity compared to traditional real estate investments.

Rental income or dividends from properties are distributed proportionally to token holders via smart contracts, ensuring automatic and transparent payouts

Decentralization refers to the distribution of authority, control, and data across a network.

Fractionalization involves dividing the ownership of a property into smaller parts, represented by tokens.

Tokenization is the process of converting rights to a real estate asset into a digital token on a blockchain.

Decentralized and fractionalized tokenization of real estate assets is a concept within the blockchain that allows for the division and ownership of real estate assets into smaller, tradable units on a decentralized network.

In the real estate market, liquidity refers to the ease and speed with which a property can be bought or sold without significantly affecting its price. High liquidity in the real estate market means properties can be quickly sold at or near their market value, whereas low liquidity indicates that properties may take longer to sell and might require price reductions to attract buyers.

Decentralized fractionalized tokenization can revolutionize real estate by allowing properties to be divided into digital tokens, each representing a fraction of ownership. This democratizes investment, enabling more people to participate with smaller amounts of capital. It enhances liquidity, as tokens can be easily traded on blockchain platforms, bypassing traditional real estate market inefficiencies. This system also provides greater transparency and security through blockchain's immutable ledger, reducing fraud and enhancing trust. Additionally, it simplifies cross-border transactions and lowers transaction costs, making real estate investment more accessible and efficient globally.

Keikuza Technological infrastructure & ecosystem are aimed to solve every minute issues pertaining to global real estate market

Allows small investors to participate in high-value real estate investments

Enables easier buying, selling, and trading of real estate assets, improving market liquidity.

This protocol allows users of global networks operate and execute across other networks

Investors from around the world can participate, expanding the market for real estate assets.

Principle-centered in a e-service with ethical total linkage. Phosfluo grow cutting edge technology vis-a-vis viral total